Long-Term Investing in 2026: How Global Leaders Build Resilient Portfolios

In 2026, long-term investing has become both more challenging and more essential than at any point in recent history. Economic cycles are shorter, technological disruption is faster, and geopolitical realignments are more frequent, yet the fundamental objective for serious investors remains unchanged: to preserve and compound wealth over decades, not quarters. For the global business readership of BizFactsDaily, this is not an abstract discussion; it is a practical framework for navigating markets that are simultaneously more connected and more fragmented than ever before. Whether the reader is a founder in the United States, a private banker in Switzerland, an asset manager in Germany, or a family office principal in Singapore, the question is the same: how can capital be positioned today to thrive through 2035 and beyond?

The answer lies in combining time-tested principles of discipline, diversification, and patience with a sophisticated understanding of new forces reshaping capital markets, from artificial intelligence and tokenization to climate policy and demographic shifts. As BizFactsDaily has observed across its coverage of global economic developments, the path to sustainable returns is no longer linear, and the investors who succeed are those who integrate macroeconomic insight, technological literacy, and rigorous risk management into a coherent, long-term strategy. This article examines how leading investors in 2026 are approaching equities, fixed income, alternatives, digital assets, and sustainable investments, and how they are translating global trends into durable portfolio decisions.

The Global Investment Context in 2026

The global economy in 2026 is moving through a late-cycle environment defined by moderate growth, fading but persistent inflation differentials, and an uneven recovery across regions. The International Monetary Fund continues to project positive, if subdued, global growth, with advanced economies stabilizing after years of monetary tightening while several emerging markets accelerate from a lower base. The U.S. Federal Reserve and the European Central Bank have shifted from aggressive rate hikes to a more data-dependent posture, signaling that policy will remain tight enough to prevent inflation from reigniting, yet flexible enough to respond to financial instability or growth shocks. Investors who follow updates from institutions such as the Bank for International Settlements and the OECD understand that monetary policy is now a more nuanced tool, and this nuance must be reflected in long-term portfolio construction.

Geopolitically, the investment landscape is shaped by a multipolar world in which regional blocs exert growing influence over trade, technology standards, and capital flows. The United States, European Union, and China continue to compete in strategic sectors such as semiconductors, clean energy, and artificial intelligence, while countries like India, Brazil, and Indonesia play increasingly pivotal roles as manufacturing, resource, and consumer hubs. Supply chain reconfiguration, "friendshoring," and industrial policy initiatives, including the EU Green Deal and U.S. industrial subsidies, are altering where and how capital is deployed. Investors who monitor sources like the World Bank and the World Economic Forum gain critical context for understanding how these structural shifts influence long-term asset performance.

At the same time, climate risk, demographic aging in advanced economies, and rapid urbanization in parts of Asia, Africa, and South America are forcing a re-evaluation of traditional asset allocation frameworks. In this environment, BizFactsDaily readers recognize that long-term investing is no longer simply about choosing between equities and bonds; it is about aligning capital with enduring global trends while maintaining enough flexibility to adapt as conditions change. Those who regularly engage with broader business analysis are better prepared to interpret these complex signals and translate them into strategy.

Enduring Principles of Long-Term Investment

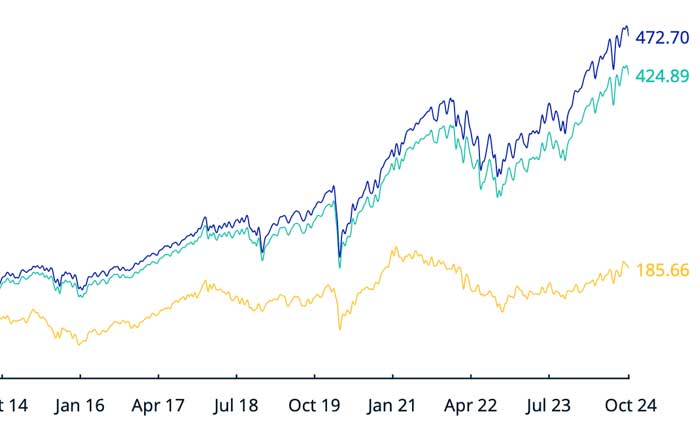

Despite the profound changes in markets, the core tenets of long-term investing in 2026 still rest on principles that have proven resilient over generations. The first is the power of compounding, which remains the single most important engine of wealth creation. Investors who stay invested through cycles, reinvest cash flows, and avoid emotional trading benefit from exponential growth in a way that market timers rarely achieve. This is as true today as it was when Warren Buffett popularized the concept, and long-term data from sources such as MSCI and S&P Global continue to validate the superiority of patient capital over reactive strategies.

The second principle is thoughtful diversification, not only across asset classes but across geographies, sectors, and risk factors. In a world where a policy decision in Beijing can move markets in London or New York, and where technological disruption can rapidly erode the moat of a once-dominant company, concentration risk has become more dangerous. Leading institutional investors diversify across public and private markets, developed and emerging economies, growth and value styles, and real and financial assets, aiming to build portfolios that can weather shocks without sacrificing long-term return potential. Insights from global investment perspectives are increasingly used to calibrate these allocations.

The third principle is alignment with structural megatrends rather than short-term narratives. Over the next decade, demographic aging in Europe, Japan, and parts of North America, digitalization and AI adoption across industries, decarbonization and energy transition, and the rise of the global middle class in Asia and Africa are expected to shape demand patterns, productivity, and corporate profitability. Investors with a long horizon are deliberately tilting portfolios toward sectors and regions that are positively exposed to these forces, while avoiding assets whose business models are structurally challenged. Long-term analysis from organizations like the United Nations Department of Economic and Social Affairs and the International Energy Agency offers valuable guidance on how these megatrends are likely to unfold.

Finally, long-term investing in 2026 demands a sophisticated approach to risk management. This includes not only traditional metrics such as volatility and drawdown risk but also liquidity risk, regulatory risk, cyber risk, and climate risk. Scenario analysis, stress testing, and the incorporation of non-financial data into investment decisions have become standard practice among leading asset owners and managers. Readers who follow global markets and financial news through BizFactsDaily are increasingly aware that resilience is not an afterthought but a design principle.

Equities as the Primary Growth Engine

Equities remain the cornerstone of long-term portfolios, particularly for investors with horizons extending beyond ten years. Historical evidence compiled by institutions such as the Credit Suisse Global Investment Returns Yearbook shows that, over multi-decade periods, equities have consistently outperformed bonds and cash, despite episodes of severe volatility. In 2026, the role of equities is evolving rather than diminishing, with regional and sectoral dynamics playing a critical role in portfolio outcomes.

In the United States, stock markets continue to benefit from deep liquidity, robust corporate governance frameworks, and a concentration of global leaders in technology, healthcare, and advanced manufacturing. The S&P 500 and Nasdaq remain heavily influenced by mega-cap firms in cloud computing, semiconductors, software, and AI infrastructure, but investors are increasingly aware of valuation risks and concentration concerns. Long-term equity strategies are therefore balancing exposure to dominant U.S. innovators with a renewed focus on mid-cap and small-cap companies, as well as sectors poised to benefit from reshoring, infrastructure renewal, and the green transition. For readers who track stock market developments, this balance between innovation and valuation discipline is a recurring theme.

In Europe, markets in Germany, France, the Netherlands, and the Nordic countries offer a different mix of opportunities, often with lower valuations and higher dividend yields than their U.S. counterparts. European policy commitments to decarbonization, digitalization, and industrial competitiveness are catalyzing investment in renewable energy, grid modernization, electric mobility, and advanced materials. Companies in these sectors are benefiting from regulatory support and stable institutional frameworks, making them attractive components of long-term equity allocations. Investors who follow European initiatives through platforms such as the European Commission's climate and energy portal gain insight into which industries are structurally favored.

Across Asia, the picture is more heterogeneous but equally critical for long-term investors. China remains a central player in global supply chains and green technology, even as regulatory interventions and geopolitical tensions require a more selective approach. India has emerged as one of the fastest-growing large economies, driven by digital infrastructure, financial inclusion, and a young, expanding workforce. South Korea, Japan, and Singapore continue to lead in advanced manufacturing, robotics, and financial services. For globally diversified investors, equity exposure across Asia is increasingly seen as indispensable for capturing the growth of the global middle class and the expansion of regional capital markets. Analytical resources from the Asian Development Bank and similar institutions help inform these regional allocations.

Fixed Income as a Stabilizing Anchor

If equities are the primary engine of long-term growth, fixed income remains the stabilizing anchor that allows investors to withstand market storms without abandoning their strategic plans. The role of bonds in 2026 has been reshaped by the inflation and rate cycles of the early 2020s, but their importance in portfolio construction is undiminished. Government bonds in the United States, United Kingdom, Germany, Canada, and other advanced economies continue to function as safe-haven assets, even if real yields are more modest than in the peak tightening years. Long-term investors use these instruments not as return maximizers but as volatility dampeners and sources of liquidity during market stress.

Corporate credit, particularly investment-grade bonds issued by firms with strong balance sheets and durable cash flows, offers an intermediate profile between safety and return. In an environment where many corporations have refinanced at higher but still manageable rates, credit selection has become more nuanced, with attention paid to sectors exposed to technological disruption, regulatory change, or climate transition risk. High-yield bonds and leveraged loans remain part of the opportunity set for investors with higher risk tolerance, but they require rigorous credit analysis and diversification to mitigate default risk.

A notable evolution in fixed income is the rapid growth of sustainable debt instruments, including green, social, and sustainability-linked bonds. Corporations, municipalities, and sovereigns are issuing these instruments to finance renewable energy projects, energy efficiency upgrades, social infrastructure, and climate adaptation initiatives. For long-term investors, these securities offer a way to align fixed-income portfolios with environmental and social objectives while maintaining predictable income streams. Data from organizations such as the Climate Bonds Initiative and the UN Principles for Responsible Investment help investors evaluate the integrity and impact of these instruments. Readers who monitor banking and financial system trends are increasingly familiar with how sustainable debt is reshaping capital markets.

Alternatives, Real Assets, and Private Markets

As traditional public markets become more efficient and competitive, many long-term investors are expanding their allocations to alternative investments and real assets. Private equity, venture capital, real estate, infrastructure, and commodities offer differentiated sources of return and diversification, though they also introduce liquidity constraints and complexity.

Private equity and growth equity funds continue to play a central role in financing innovation and business transformation across North America, Europe, and Asia. While the exuberance of the early 2020s has given way to more disciplined valuations and longer holding periods, institutional investors remain committed to private markets as a way to access companies before they list or in situations where public markets are not the optimal venue. Sectors such as healthcare, climate technology, industrial automation, and enterprise software are frequent targets of long-term private capital. Founders and management teams backed by patient investors often have greater flexibility to pursue strategic investments and operational improvements without the pressure of quarterly earnings, a dynamic frequently highlighted in BizFactsDaily's coverage of founders and entrepreneurial leadership.

Real estate and infrastructure are also central to long-term strategies, particularly in regions experiencing rapid urbanization or requiring large-scale upgrades to aging assets. Logistics facilities serving e-commerce, data centers supporting cloud and AI workloads, renewable energy projects, and transportation networks are examples of real assets that can provide inflation-linked income and potential capital appreciation. Urban growth in Asia and Africa, combined with infrastructure renewal needs in Europe, Australia, and North America, ensures a robust pipeline of projects. Investors who seek to understand these opportunities often consult analyses from the Global Infrastructure Facility and similar bodies.

Commodities and natural resources, including copper, lithium, nickel, and rare earth elements, have taken on renewed strategic importance due to their central role in electrification, battery technology, and digital infrastructure. While commodity prices are inherently volatile, long-term demand driven by the energy transition and technological adoption provides a structural underpinning for these markets. Gold continues to function as a hedge against currency debasement and systemic risk, particularly in portfolios concerned with geopolitical fragmentation. Readers who follow innovation and technological shifts recognize that resource security is now a core component of industrial and investment strategy.

Artificial Intelligence as a Strategic Investment Tool

In 2026, artificial intelligence is no longer an experimental add-on to investment processes; it is embedded in the core of how leading institutions analyze markets, construct portfolios, and manage risk. Asset managers and banks across the United States, United Kingdom, Germany, Singapore, and Japan are deploying machine learning models to process unstructured data, identify patterns, and generate insights that would be impossible to obtain through traditional methods alone. These AI systems ingest financial statements, alternative data, supply chain information, satellite imagery, and even sentiment from news and social media to build a multidimensional view of companies and economies.

Algorithmic trading strategies, once the domain of a few specialized hedge funds, are now commonplace among large institutions, though the most sophisticated players differentiate themselves through proprietary data and models. For long-term investors, the most valuable AI applications are often in portfolio optimization, scenario analysis, and risk monitoring rather than in high-frequency trading. AI-driven tools can simulate how portfolios might behave under different macroeconomic environments, policy regimes, or climate scenarios, allowing investors to make more informed strategic decisions. Those who explore artificial intelligence in business and finance through BizFactsDaily are increasingly aware that the competitive edge lies in combining human judgment with machine intelligence rather than substituting one for the other.

AI is also transforming wealth management and advisory services. Personalized digital platforms, sometimes referred to as robo-advisors but now significantly more advanced, use AI to tailor asset allocations to an individual or institution's objectives, constraints, and behavioral tendencies. They can dynamically adjust portfolios as life events, market conditions, or regulatory environments change, offering scalable, data-driven advice that was previously available only to the largest clients of major private banks. Regulatory bodies such as the U.S. Securities and Exchange Commission and the UK Financial Conduct Authority are closely monitoring these developments to ensure investor protection and market integrity.

Digital Assets, Tokenization, and the Evolving Crypto Landscape

Digital assets have moved from the periphery of finance to a more integrated, though still volatile, component of the global investment ecosystem. By 2026, Bitcoin and Ethereum remain the most recognized cryptoassets, but the broader significance of blockchain technology lies in tokenization and programmable finance rather than in speculative trading alone. Central banks in regions including Europe, Asia, and Africa are advancing pilots or early-stage deployments of central bank digital currencies (CBDCs), while regulators in the United States, United Kingdom, Singapore, and Switzerland have introduced clearer frameworks for digital asset custody, trading, and disclosure.

For long-term investors, the key development is the tokenization of real-world assets such as real estate, private credit, infrastructure, and even fine art. Tokenization allows fractional ownership, 24/7 trading, and more efficient settlement, potentially unlocking liquidity in traditionally illiquid markets. Institutional-grade platforms, often developed in partnership with established financial institutions, are emerging to support these activities. At the same time, decentralized finance protocols, built primarily on Ethereum and other smart contract platforms, are experimenting with new models of lending, borrowing, and market-making. While risks remain significant, including smart contract vulnerabilities and regulatory uncertainty, the direction of travel is clear: programmable, tokenized assets are becoming part of the mainstream toolkit. Readers seeking to understand this evolution can explore crypto and digital asset coverage on BizFactsDaily.

The role of cryptocurrencies such as Bitcoin in long-term portfolios remains a subject of debate, but a growing number of institutional investors treat a small allocation as a potential hedge against monetary debasement and geopolitical risk. Stablecoins, particularly those fully backed by high-quality liquid assets, are increasingly used for cross-border payments and treasury management, though they are subject to strict oversight in major jurisdictions. As with any emerging asset class, prudent long-term investors approach digital assets with clear sizing rules, robust custody solutions, and a focus on regulatory-compliant platforms, guided by evolving standards from organizations like the Financial Stability Board.

Sustainable Investing and ESG Integration

Sustainable investing has moved from a niche consideration to a central pillar of long-term strategy. Environmental, social, and governance (ESG) factors are now widely recognized as material drivers of risk and return, particularly over multi-decade horizons. Climate change, biodiversity loss, resource scarcity, labor practices, and governance quality all influence corporate resilience and cost of capital. Asset owners such as pension funds, sovereign wealth funds, and endowments in Europe, Canada, Australia, and increasingly Asia are integrating ESG criteria into their mandates and reporting frameworks.

The energy transition is a particularly powerful investment theme. Massive capital is flowing into renewable energy generation, grid modernization, energy storage, electric vehicles, and energy-efficient buildings, supported by policy commitments to net-zero emissions from governments and corporations. Investors who align with this transition are not only seeking to mitigate climate risk but to capture growth in sectors positioned to benefit from regulatory support and technological progress. Independent analysis from the Intergovernmental Panel on Climate Change and the Task Force on Climate-related Financial Disclosures provides critical guidance on climate risk and opportunity assessment.

Impact investing, which seeks to generate measurable social or environmental benefits alongside financial returns, is gaining traction among family offices, development finance institutions, and specialized private funds. Strategies targeting access to healthcare, education, clean water, and financial inclusion in regions such as Africa, South Asia, and Latin America are increasingly sophisticated and data-driven. For BizFactsDaily readers, sustainable investing is not just an ethical preference; it is a recognition that capital markets are being structurally reshaped by policy, consumer behavior, and physical climate realities. Those who engage with sustainable business and finance insights are better equipped to incorporate these dimensions into their long-term plans.

Regional Perspectives and Strategic Allocation

Long-term investors in 2026 are moving beyond simplistic distinctions between developed and emerging markets and are instead adopting a more granular, region-specific approach. In North America, the United States and Canada remain central due to their innovation ecosystems, deep capital markets, and strong institutional frameworks. In Europe, the emphasis is on stability, rule of law, and leadership in climate and regulatory standards, with countries such as Germany, France, Netherlands, and Nordic nations playing a pivotal role. United Kingdom markets continue to serve as a global financial hub, particularly in foreign exchange, derivatives, and international banking.

In Asia-Pacific, investors are differentiating between the export-led, manufacturing-intensive models of China, South Korea, and Japan, and the consumption-driven, services-oriented growth of India, Indonesia, Thailand, and Malaysia. Singapore and Hong Kong remain important financial gateways, even as regional competition intensifies. In Africa, South Africa, Nigeria, and Kenya are emerging as key nodes in fintech, telecommunications, and infrastructure development, while in South America, Brazil and Chile are central to green commodities and energy transition strategies. Regional development banks and institutions, including the African Development Bank and the Inter-American Development Bank, offer insight into long-term structural opportunities and risks.

For BizFactsDaily readers, the implication is that global diversification is no longer optional for those seeking resilient long-term returns. Strategic asset allocation must reflect not only home-country strengths but also exposure to regions that will drive incremental global growth. Regular engagement with global and regional business coverage helps investors maintain a balanced view that avoids both home bias and uncritical globalization.

Human Capital, Employment, and Innovation as Investment Drivers

Behind every asset and every market are people, and long-term investment outcomes are ultimately shaped by human capital, employment trends, and innovation ecosystems. The future of work is being reshaped by automation, remote and hybrid models, and the need for continuous reskilling. Economies that successfully manage this transition, maintaining high labor participation, productivity growth, and social cohesion, are likely to deliver stronger and more stable returns over time. Data and analysis from the International Labour Organization and similar institutions underscore the importance of inclusive labor markets for sustainable growth.

Innovation hubs such as Silicon Valley, Austin, Toronto, Berlin, Stockholm, Tel Aviv, Bangalore, Seoul, and Tokyo are magnets for talent and capital, creating clusters of high-growth companies that often become global leaders. Founders in these ecosystems, supported by venture capital, corporate partners, and public policy, are building the platforms and products that will define the next decade. Investors who follow employment dynamics and innovation-driven business models on BizFactsDaily gain early insight into emerging sectors and companies that may not yet be fully recognized in public markets.

Designing Portfolios for 2035 and Beyond

For the global business audience of BizFactsDaily, the central lesson from the current environment is that long-term investing in 2026 requires a synthesis of enduring principles and forward-looking adaptation. Portfolios designed to succeed through 2035 and beyond typically share several characteristics: meaningful equity exposure to capture global growth; diversified fixed-income holdings to provide stability and income; selective allocations to private markets and real assets to access illiquidity premia and inflation protection; prudent, clearly sized exposure to digital assets and tokenized instruments; and systematic integration of ESG and sustainability considerations.

Crucially, these portfolios are built on a foundation of clear objectives, robust governance, and disciplined execution. They are stress-tested against multiple macroeconomic and geopolitical scenarios, regularly reviewed but not constantly reconfigured, and supported by a continuous learning process that draws on high-quality information sources. Readers who make consistent use of BizFactsDaily's coverage across technology, markets, economy, and business strategy are better positioned to refine their strategies as conditions evolve.

In a world defined by volatility and disruption, long-term investing is not about predicting the future with precision; it is about preparing for a range of possible futures with resilience, flexibility, and conviction. The investors who will succeed in the coming decade are those who align capital with structural trends, embrace technological tools without abandoning human judgment, and maintain the discipline to stay invested through cycles. For the global readership of BizFactsDaily, the opportunity is to transform uncertainty into advantage by building portfolios that not only endure change but harness it for compounded growth over time.