Founders, AI, and the New Decision-Making Playbook in 2026

AI Moves from Experimental Tool to Core Strategic Infrastructure

By 2026, artificial intelligence has firmly established itself as a foundational layer of modern business strategy, and for founders across North America, Europe, Asia, Africa and South America, it now functions less as a novel experiment and more as an essential component of how decisions are framed, validated and executed. For the global readership of BizFactsDaily, which closely follows developments in artificial intelligence, business, economy, technology and related domains, the shift is visible in almost every founder conversation: AI has become a strategic co-pilot rather than a back-office utility. Founders in the United States, United Kingdom, Germany, Canada, Australia, Singapore and beyond now routinely describe AI as the analytical backbone that supports choices on product direction, capital allocation, market entry and organizational design, while also serving as a continuous feedback mechanism that refines those choices in real time as conditions change.

This transformation has been accelerated by the rapid maturation of large language models, multimodal systems and domain-specific AI platforms provided by organizations such as OpenAI, Google, Microsoft and Anthropic, which have dramatically lowered the technical and financial barriers to sophisticated analytics. Instead of building large in-house data science teams from scratch, founders can now orchestrate a combination of cloud-based AI services, open-source frameworks and proprietary data to generate insights that were previously the domain of only the largest incumbents. Reports from institutions such as the World Economic Forum describe how AI is rewiring value chains across manufacturing, logistics, financial services and healthcare, and founders are internalizing these findings as they design companies that are more data-native and resilient to macroeconomic and geopolitical volatility. For readers who track cross-border trends via global business coverage on BizFactsDaily, it is increasingly clear that AI is no longer a differentiator only for technology companies; it is a prerequisite for competitive relevance across virtually every sector.

From Intuition to Data-Augmented Judgment

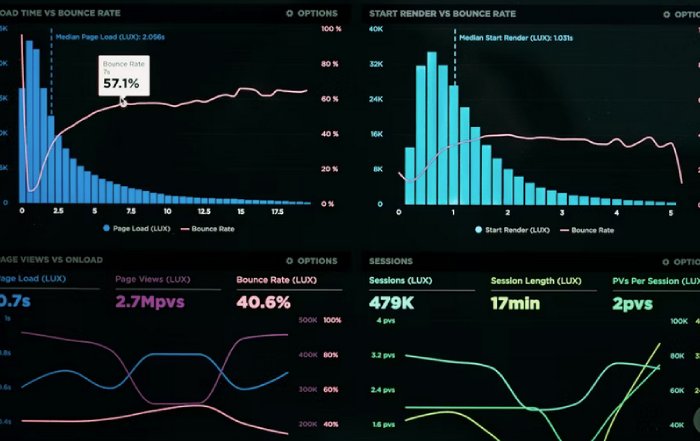

Founders have always depended on intuition, pattern recognition and personal experience, particularly in ambiguous environments where data is incomplete and time is constrained. What distinguishes the 2026 landscape is not the disappearance of intuition but its systematic augmentation through AI-driven analytics, scenario modeling and real-time feedback loops. Instead of relying on static spreadsheets and historical reports, founders now lean on systems that ingest live streams of structured and unstructured data, generate probabilistic forecasts and highlight non-obvious correlations that might challenge entrenched assumptions. On BizFactsDaily, readers of investment and economy coverage see this in the way founders discuss decision processes that combine macroeconomic indicators from organizations such as the International Monetary Fund and World Bank with granular operational metrics and customer behavior data.

A founder building a lending platform for small and medium-sized enterprises in Germany, for example, can now harness AI models that integrate historical default data, real-time sector indicators, and monetary policy signals from institutions like the European Central Bank to refine credit risk segmentation and pricing decisions. Similarly, a retail founder in the United States can use AI-based demand forecasting tools that merge point-of-sale data, weather forecasts, event calendars and social sentiment to guide inventory, staffing and promotion strategies with a level of precision that manual analysis cannot match. Management research from organizations such as McKinsey & Company and MIT Sloan Management Review continues to show that companies embedding advanced analytics into core decision workflows outperform peers on revenue growth and margin resilience, and founders are actively translating these insights into their own operating models. For the BizFactsDaily audience, this shift toward data-augmented judgment is not an abstract trend; it is increasingly the baseline expectation for credible leadership.

AI as a Catalyst for Strategic Foresight

Strategic foresight has traditionally been a slow, consultant-heavy exercise focused on multi-year planning cycles, but AI has compressed and democratized this capability for founder-led organizations operating in volatile markets. By 2026, founders across the United States, Europe, Asia-Pacific and Africa are embedding AI into their foresight processes to monitor regulatory developments, technological inflection points, competitive moves and evolving customer expectations in near real time. Readers who follow news and global insights on BizFactsDaily see how AI-enabled foresight is helping companies navigate fragmented supply chains, energy transitions, digital regulation and geopolitical risk with more agility and nuance than in previous cycles.

Modern AI systems can continuously parse vast volumes of policy documents, legislative debates, patent filings, research papers and industry commentary, transforming them into structured signals that highlight emerging themes and potential discontinuities. A climate-tech founder in Sweden, for instance, might use natural language processing tools to track regulatory proposals and technical standards emerging from the European Commission and EUR-Lex, enabling early alignment of product features with forthcoming carbon disclosure and taxonomy requirements. A fintech or digital asset founder in Singapore or the United Kingdom can similarly monitor regulatory updates from authorities such as the Monetary Authority of Singapore and Financial Conduct Authority, using AI to map how evolving rules around digital payments, open banking and crypto-assets could influence product roadmaps, risk models and partnership strategies. Resources from think tanks and policy observatories, including the OECD and various national economic institutes, can be fed into these systems to enrich scenario analysis and stress testing.

The objective is not to predict the future with false certainty, but to expand the range of plausible futures that founders consider, to detect weak signals earlier and to connect those signals to concrete strategic options. When combined with the kind of grounded sector knowledge that BizFactsDaily regularly highlights in its founder profiles and market analyses, AI-enabled foresight allows leaders to articulate clearer narratives to boards, investors and employees about why specific strategic bets are being made and under what conditions those bets might be revisited.

Financial Discipline and Capital Allocation in an AI-First Environment

Capital allocation remains one of the defining responsibilities of any founder, and in 2026 AI has become a central instrument for bringing greater discipline, transparency and speed to financial decision making. For readers who follow banking and stock markets reporting on BizFactsDaily, the influence of AI on institutional finance has long been evident in algorithmic trading, risk modeling and automated compliance; what has changed is that similar analytical sophistication is now available to early-stage and mid-market companies at accessible price points.

AI-powered financial planning and analysis platforms can integrate transactional data, pipeline forecasts, cost structures and macroeconomic indicators, including interest rate paths, inflation expectations and commodity prices, often sourced from central banks and statistical agencies. These platforms then generate probabilistic scenarios for revenue, cash burn and runway, flagging early warning signs such as deteriorating unit economics or concentration risk. Founders can simulate the impact of different pricing strategies, go-to-market investments or hiring plans on liquidity and valuation, informed by benchmark data from sources such as PitchBook and CB Insights, which increasingly expose their datasets through AI-ready APIs. Guidance from regulatory bodies and market watchdogs, including the U.S. Securities and Exchange Commission, is also being embedded into AI tools to help founders understand disclosure obligations and governance expectations as they approach public markets.

For listed companies led by founder-CEOs in markets such as the United States, United Kingdom, Germany and Singapore, AI analytics are being used to better understand investor behavior, refine earnings guidance ranges and craft communication strategies that address the concerns of different shareholder segments. While compliance rules limit the use of certain predictive tools for trading, AI remains highly valuable in modeling how different strategic announcements or macro shocks might influence analyst expectations and valuation multiples. By combining AI-enabled financial insight with human judgment, independent oversight and clear documentation, founders can reinforce their reputation for prudence and transparency, attributes that BizFactsDaily readers consistently identify as markers of trustworthy leadership.

Customer Insight, Marketing and the AI-Driven Growth Engine

In an environment where markets are increasingly saturated and customer expectations continue to rise, founders are turning to AI to transform how they understand, acquire and retain customers. Across the United States, Europe, Asia and Latin America, AI-powered customer data platforms and marketing systems now sit at the heart of many founder-led growth strategies, enabling a level of personalization, experimentation and optimization that would have been unmanageable with manual methods. Coverage on BizFactsDaily in marketing and technology shows how AI is reshaping segmentation, messaging, pricing and customer support in both B2C and B2B contexts.

Modern platforms unify behavioral data from websites, mobile apps, CRM systems, offline touchpoints and, increasingly, connected devices, then apply machine learning to identify high-value segments, predict churn, recommend cross-sell opportunities and optimize channel mix. Research from firms such as Gartner and Forrester continues to demonstrate that organizations using advanced analytics in their go-to-market strategies see materially higher revenue growth and customer lifetime value than those that do not, and founders are acting on these findings by baking experimentation into their operating rhythms. An e-commerce founder in Spain or Italy, for example, can use AI to test hundreds of creative and pricing combinations across social and search channels, automatically reallocating budget to the best-performing variants in near real time. A mobility or logistics startup in Brazil or South Africa can use AI to dynamically adjust pricing, route planning and incentive schemes based on traffic patterns, demand spikes and local events.

Natural language processing adds another dimension by allowing founders to systematically analyze customer feedback from reviews, support tickets, chat transcripts and social media, extracting themes and sentiment that inform product decisions and service improvements. The integration of generative AI into customer support, marketing content creation and sales enablement has further accelerated time-to-market, while raising important questions about authenticity, brand voice and disclosure that responsible founders are beginning to codify into internal guidelines. For BizFactsDaily readers, these developments underscore a central reality of 2026: sustainable growth increasingly depends on the ability to combine AI-driven precision with a human understanding of context, culture and brand.

Redefining Work and Talent in Founder-Led Organizations

The impact of AI on decision making extends deep into how founders design organizations, define roles and manage talent. In 2026, AI is embedded in workforce planning, skills management and performance oversight, and the way founders handle these tools is becoming a critical determinant of employer reputation and culture. Readers of employment and innovation content on BizFactsDaily see how AI is simultaneously automating routine tasks, creating new categories of work and reshaping expectations around productivity and learning across the United States, United Kingdom, Germany, India, South Africa and other key markets.

AI-based talent analytics platforms can map the skills portfolio of an organization, identify gaps relative to strategic priorities and propose reskilling or hiring pathways. These systems draw on internal data such as project histories, performance feedback and learning records, as well as external labor market information from sources like LinkedIn's Economic Graph and skills taxonomies developed by the OECD, to suggest how employees might transition into emerging roles such as AI product management, data governance, automation engineering or prompt design. Recruitment processes are increasingly supported by AI tools that screen applications, schedule interviews and even conduct initial assessments, though leading founders are acutely aware of the risks of bias and opacity in these systems. Regulatory guidance from entities such as the U.S. Equal Employment Opportunity Commission and various European data protection authorities is therefore being integrated into AI governance frameworks to ensure that hiring and promotion decisions remain fair, explainable and contestable.

Research from institutions including Harvard Business School and Stanford University continues to show that when AI is deployed as an augmentation tool rather than a blunt instrument of cost-cutting, organizations can achieve higher productivity, stronger engagement and better innovation outcomes. Founders who communicate clearly about the role of AI, invest in upskilling and create channels for employees to question or appeal AI-influenced decisions are building cultures of trust that will be difficult for competitors to replicate. For the BizFactsDaily audience, which spans founders, executives and investors, the message is increasingly clear: the credibility of a company's AI strategy is inseparable from the credibility of its people strategy.

Governance, Ethics and Regulation: Building Trustworthy AI at Scale

As AI becomes entangled with high-stakes decisions in finance, employment, healthcare, infrastructure and public services, governance and ethics have moved from peripheral concerns to central strategic issues for founders. In 2026, operating a data- and AI-driven business in major markets such as the European Union, United States, United Kingdom, Singapore and Japan requires not only technical competence but also a robust framework for responsible AI. Readers of sustainable business and ESG-focused coverage on BizFactsDaily see how AI governance is increasingly intertwined with broader sustainability, risk and compliance agendas.

The European Union's AI Act, now moving into implementation, sets out risk-based requirements for transparency, data quality, human oversight and accountability, particularly for high-risk applications in areas such as credit scoring, recruitment and critical infrastructure. In the United States, agencies including the Federal Trade Commission and Consumer Financial Protection Bureau have expanded their focus on algorithmic unfairness, deceptive AI marketing claims and discriminatory outcomes in lending, employment and advertising. Jurisdictions such as Singapore and Japan have published detailed AI governance frameworks and model guidelines that encourage innovation while emphasizing accountability, explainability and human-centric design. Founders operating across borders must therefore design AI systems that meet or exceed the strictest applicable standards, often adopting a "highest bar" approach to privacy, security and fairness.

Practically, this translates into cross-functional AI governance committees, formal impact assessments for high-risk use cases, continuous monitoring of model performance and drift, and clear documentation of training data, assumptions and limitations. External audits, red-teaming exercises and advisory councils are becoming more common among founder-led companies that wish to demonstrate seriousness about responsible AI to regulators, customers and partners. Resources from initiatives such as the OECD AI Policy Observatory and multi-stakeholder organizations like the Partnership on AI provide frameworks and case studies that founders can adapt to their own contexts. For BizFactsDaily, which places a strong emphasis on experience, expertise, authoritativeness and trustworthiness, these governance practices are not peripheral details; they are integral to assessing whether a company's AI strategy is sustainable and investable.

Sector-Specific Transformations: Finance, Crypto and Climate Tech

The way AI shapes founder decision making varies significantly across sectors, reflecting differences in regulation, data availability and business models. In banking and financial services, AI is now central to credit risk modeling, fraud detection, customer onboarding and personalized advisory services. Founders of digital banks and fintechs in the United Kingdom, Germany, Canada, Singapore and Australia are using AI to meet stringent know-your-customer and anti-money laundering rules, drawing on transaction monitoring tools and identity verification platforms that operate in real time. Global standard setters such as the Bank for International Settlements and Financial Stability Board continue to publish analyses on the systemic implications of AI in finance, and founders are increasingly expected to demonstrate that their models enhance, rather than undermine, financial stability and consumer protection. Readers can follow these developments alongside BizFactsDaily's banking and stock markets coverage to understand how regulatory expectations and technological possibilities intersect.

In the crypto and broader digital asset ecosystem, AI has become indispensable for monitoring on-chain activity, detecting illicit flows, managing liquidity and designing tokenomics that support long-term ecosystem health. As regulators in the United States, European Union and Asia tighten oversight of exchanges, stablecoins and decentralized finance protocols, founders are turning to AI tools that integrate guidance from bodies such as the Financial Action Task Force and national securities regulators to maintain compliance while still innovating at the protocol and product layers. For readers of BizFactsDaily's crypto and global sections, this convergence of AI, regulation and decentralized infrastructure is reshaping competitive dynamics across exchanges, wallets, custody providers and Web3 infrastructure companies.

Climate tech and sustainability-focused ventures offer another vivid illustration of AI's strategic role. Founders working on renewable energy optimization, carbon accounting, sustainable agriculture or climate risk analytics rely on AI to process satellite imagery, IoT sensor data, supply chain records and climate models. Data and scenarios from organizations such as the Intergovernmental Panel on Climate Change and International Energy Agency are increasingly fed into AI systems that help corporates and governments quantify transition and physical risks, evaluate mitigation options and prioritize investments. For readers who track sustainable business and investment trends on BizFactsDaily, AI-enabled climate analytics are becoming a core element of how founders demonstrate both impact and financial viability to investors and customers.

The Evolving Founder Skill Set in an AI-Centric World

As AI takes on more of the analytical workload, the profile of an effective founder is evolving. Technical literacy around AI is now a baseline expectation among investors and senior hires, not because every founder must be a machine learning engineer, but because they must understand the capabilities, limitations and risks of AI well enough to set direction, ask challenging questions and make informed trade-offs. Executive education programs from platforms such as Coursera, edX, Stanford Online and Harvard Online are seeing strong founder participation in courses on AI strategy, data ethics and digital transformation, reflecting a recognition that credibility in 2026 requires more than generic digital fluency.

Beyond technical understanding, founders must excel at integrating quantitative insight with qualitative judgment, crafting narratives that connect model outputs to human experience, brand values and societal context. They need to build cross-functional teams that bring together product, engineering, data science, legal, compliance and operations, and to establish operating rhythms where experimentation is encouraged but guardrails are clearly defined. Profiles of leaders in founders coverage on BizFactsDaily increasingly highlight these capabilities, showcasing entrepreneurs in the United States, United Kingdom, India, South Africa, Brazil, Singapore and elsewhere who can navigate both the promise and complexity of AI-driven decision making.

Resilience and adaptability are also becoming defining traits. AI tools that feel cutting-edge in early 2026 may be commoditized or regulated differently within a few years, and founders who treat AI adoption as a one-off project rather than a continuous capability-building journey risk obsolescence. By investing in flexible data architectures, modular AI stacks, and ongoing learning programs for themselves and their teams, and by staying connected to global research and policy communities through organizations such as the World Economic Forum and OECD, founders can maintain decision frameworks that remain robust even as technology, regulation and competitive dynamics continue to shift.

How BizFactsDaily Supports Founders in the AI Transition

For BizFactsDaily, this global transformation in founder decision making is not simply a topic to report on; it is central to the mission of the platform and to the expectations of its audience. Readers come to BizFactsDaily from the United States, United Kingdom, Germany, Canada, Australia, France, Italy, Spain, Netherlands, Switzerland, China, Singapore, South Korea, Japan, South Africa, Brazil and many other markets seeking practical, trustworthy insight at the intersection of strategy, technology and markets. Whether they are exploring AI's impact on artificial intelligence strategy, business models, employment structures, innovation pipelines or news developments, they expect analysis that reflects real-world founder experience as well as the latest research and regulatory thinking.

By combining expert commentary, founder interviews, sector deep dives and regional perspectives, BizFactsDaily aims to help decision makers separate signal from noise in an AI-saturated information environment. The platform's editorial focus on experience, expertise, authoritativeness and trustworthiness is deliberate, particularly in an era where AI-generated content can blur the line between insight and speculation. Readers exploring topics from crypto regulation to economy outlooks, from stock markets volatility to technology disruption, increasingly rely on BizFactsDaily as a central reference point that connects global developments with the practical realities of founder-led organizations.

As AI continues to evolve through 2026 and beyond, founders who combine advanced analytics with human judgment, ethical clarity and a commitment to continuous learning will be best positioned to build resilient, innovative and trusted companies. BizFactsDaily will remain closely engaged with this evolution, providing its global business audience with the context, frameworks and real-world examples needed to navigate an AI-first world with confidence, discipline and responsibility. Readers who want to stay ahead of these shifts can continue to explore the latest coverage across business, innovation and the broader insights available on bizfactsdaily.com, where AI is treated not as a buzzword, but as a defining force reshaping how modern founders think, decide and lead.