How Sustainable Business Became a Magnet for Global Capital in 2026

Sustainability as a Core Signal in Capital Markets

By 2026, sustainability has become a defining lens through which global capital evaluates companies, sectors, and even entire economies, and this shift is now so entrenched that it is reshaping how risk, value, and long-term resilience are understood across markets. What began a decade ago as a specialized focus for environmental, social, and governance (ESG) funds has transformed into a mainstream expectation for leading institutional investors, sovereign wealth funds, global banks, and technology-driven asset managers. For the international readership of BizFactsDaily.com-spanning senior decision-makers in artificial intelligence, banking, crypto, technology, and traditional business across North America, Europe, Asia-Pacific, Africa, and South America-sustainable business practices are no longer an optional add-on to strategy; they are a primary determinant of access to capital, pricing of risk, and credibility in the eyes of sophisticated investors.

This structural shift has been accelerated by the convergence of several forces: increasingly stringent regulation, growing climate and social risks, rapid advances in data and analytics, and a new generation of asset owners that demand portfolios aligned with long-term environmental and societal stability. Global institutions such as BlackRock, HSBC, Temasek, and leading pension funds in the United States, Canada, the Netherlands, and Australia now embed sustainability metrics into their core investment frameworks rather than treating them as peripheral screens. Standard setters including the International Sustainability Standards Board (ISSB) and the Task Force on Climate-related Financial Disclosures (TCFD)-now largely integrated into national rulebooks-have established a common language for climate and sustainability reporting, providing investors with greater comparability and reliability. Readers following the macro context through the BizFactsDaily economy section see this reflected in how sustainability considerations influence sovereign debt spreads, sectoral capital expenditure, and corporate cost of capital across the United States, United Kingdom, Germany, Canada, Australia, France, Japan, Singapore, and beyond.

The Capital Logic Behind Sustainable Practices

Investors in 2026 increasingly treat sustainability as a proxy for long-term risk management, operational resilience, and strategic foresight, rather than as a matter of branding or short-term reputation. Systemic risks such as climate change, water scarcity, biodiversity loss, social unrest, and governance failures have proven to be financially material, affecting supply chain continuity, regulatory exposure, insurance costs, brand equity, and access to key markets. The Network for Greening the Financial System (NGFS), a coalition of central banks and supervisors, has continued to highlight how climate and environmental risks can propagate through the financial system, and its climate scenarios are now widely used by banks and investors to assess portfolio resilience and transition risk. Central banks such as the Federal Reserve and the European Central Bank have embedded climate risk into supervisory expectations, which in turn shape how commercial banks price credit and allocate balance sheet capacity, a development closely tracked by readers of BizFactsDaily's banking coverage.

From a valuation standpoint, companies with credible sustainability strategies often exhibit more stable cash flows, reduced regulatory and litigation risk, and stronger relationships with employees, customers, and communities, all of which contribute to improved risk-adjusted returns over longer horizons. Research from institutions such as Harvard Business School and the Organisation for Economic Co-operation and Development (OECD) has documented correlations between strong ESG performance and lower volatility, better operational performance, and in many sectors a lower cost of capital. Executives and investors can explore these dynamics in greater depth through resources like the OECD's responsible business conduct portal and the World Economic Forum's work on stakeholder capitalism, which analyze how sustainability influences corporate performance and capital flows across advanced and emerging markets. As a result, asset managers in major financial centers-from New York and London to Frankfurt, Singapore, and Tokyo-have come to view sustainability metrics as leading indicators of management quality and strategic agility.

Regulatory Convergence and the Global Baseline

Regulation has been one of the most powerful forces embedding sustainability into global finance, and by 2026 a de facto global baseline has emerged, even though regional differences remain. In the European Union, the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy for sustainable activities have imposed detailed requirements on how financial institutions classify and disclose the sustainability profile of their products, compelling asset managers and insurers to scrutinize the underlying practices of portfolio companies. The Corporate Sustainability Reporting Directive (CSRD) has entered into force for large European and many non-European companies with EU listings or operations, significantly expanding mandatory disclosures on climate, environmental, human rights, and governance topics. Businesses operating in or serving the EU rely on the European Commission's sustainable finance portal to navigate evolving rules, while investors use these disclosures to compare companies across sectors and geographies.

In the United States, the U.S. Securities and Exchange Commission (SEC) has moved ahead with climate-related disclosure rules that draw heavily on TCFD principles, requiring listed companies to report on governance, strategy, risk management, and metrics related to climate risks. Although political debates around ESG terminology continue, large U.S. and Canadian pension funds and asset managers increasingly require robust climate and sustainability data as a condition of capital allocation. Market participants follow these developments closely via the SEC's climate disclosure resources, which provide guidance on reporting expectations and enforcement priorities. For the global audience of BizFactsDaily's news section, these regulatory shifts illustrate how sustainability considerations are now woven into the legal fabric of capital markets from North America to Europe and Asia.

Across Asia-Pacific, regulatory initiatives have accelerated. The Monetary Authority of Singapore (MAS) has strengthened its guidelines on environmental risk management for banks, insurers, and asset managers, while promoting green and transition taxonomies through its Green Finance Industry Taskforce. Japan's Financial Services Agency (FSA) has expanded stewardship and corporate governance codes that encourage institutional investors to engage companies on climate and broader ESG issues. South Korea, Thailand, and Malaysia have introduced mandatory sustainability reporting for listed firms, and several African and Latin American regulators are following suit. Complementing this patchwork, the ISSB has finalized global sustainability and climate disclosure standards that many jurisdictions are now adopting or aligning with, creating a more consistent baseline for investors assessing companies across continents.

Investor Expectations Across Asset Classes

By 2026, sustainable business practices influence capital allocation across all major asset classes, with implications for both public and private markets. In global equity markets, index providers and large asset managers incorporate ESG scores, climate transition indicators, and controversy assessments into index design, passive fund construction, and active portfolio strategies. Services such as MSCI ESG Research and S&P Global Sustainable1 provide detailed company-level analyses that feed into benchmark composition and stock selection, which directly affects the flow of passive capital and the behavior of benchmark-aware active managers. Readers tracking these developments through BizFactsDaily's stock markets insights recognize that sustainability performance can influence everything from index inclusion and analyst coverage to valuation multiples.

In fixed income, green, social, sustainability, and sustainability-linked bonds have matured into a multi-trillion-dollar segment, with issuers ranging from sovereigns and municipalities to banks, utilities, and technology firms in markets such as France, Italy, Spain, Brazil, South Africa, China, and New Zealand. The International Capital Market Association (ICMA) continues to refine its Green Bond Principles and related frameworks, which investors use to assess the credibility of labeled bonds and avoid greenwashing. Coupon step-up mechanisms and key performance indicator-linked structures are now common in sustainability-linked bonds, creating direct financial incentives for issuers to meet climate or social targets. Central banks and regulators increasingly recognize these instruments as important tools for financing the transition to low-carbon and inclusive economies, and some provide preferential treatment or dedicated facilities to support their growth.

Private equity and venture capital have also internalized sustainability, particularly in innovation hubs across the United States, United Kingdom, Germany, Sweden, Singapore, Australia, and Canada. Leading firms integrate ESG factors into due diligence, portfolio monitoring, and exit planning, examining how business models contribute to decarbonization, resource efficiency, financial inclusion, digital responsibility, and social impact. The UN-supported Principles for Responsible Investment (PRI) offer detailed guidance on integrating ESG into private markets, which many general partners now follow as limited partners demand stronger ESG integration. For entrepreneurs and founders who rely on BizFactsDaily's founders section and innovation coverage, this means that a compelling sustainability narrative-backed by data and realistic milestones-has become a prerequisite for attracting institutional-grade growth capital.

Technology, Data, and the Expanding Role of Artificial Intelligence

The rapid evolution of artificial intelligence and advanced analytics has fundamentally changed how sustainability performance is measured, monitored, and priced by capital markets. AI models now ingest vast volumes of structured and unstructured data-from satellite imagery and sensor data to news articles, regulatory filings, and social media-to detect climate risks, supply chain vulnerabilities, labor controversies, and governance red flags in near real time. Energy and emissions scenarios published by organizations such as the International Energy Agency (IEA), accessible through its climate and energy data resources, are routinely embedded into scenario analysis tools used by banks, insurers, and asset managers to evaluate transition pathways and stranded asset risk.

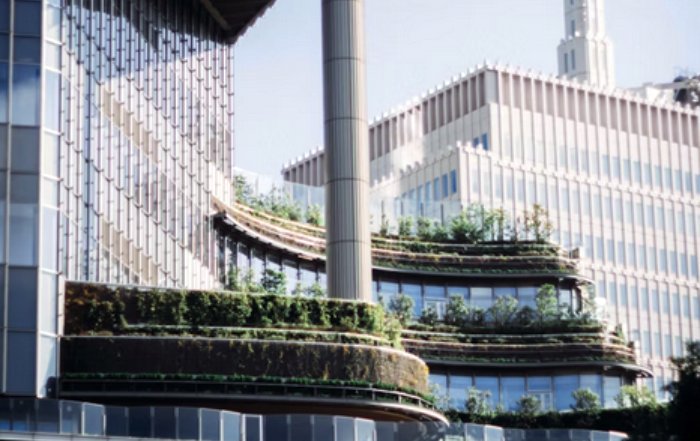

Digital reporting platforms and sustainability management systems have become standard infrastructure for large and mid-sized companies, enabling them to gather data across global operations, align disclosures with ISSB and TCFD frameworks, and respond to increasingly granular investor questionnaires. For readers of BizFactsDaily's technology section and artificial intelligence coverage, the intersection of AI and sustainability presents both a competitive opportunity and a governance challenge. On one side, AI optimizes energy use in manufacturing, logistics, and buildings, improves predictive maintenance, and supports more precise agricultural and resource management practices, particularly in regions such as Europe, Asia, and Africa where infrastructure constraints are acute. On the other, large-scale AI models and data centers consume substantial electricity and water, raising questions about energy sourcing, efficiency, and environmental impact. Research teams at institutions like MIT and Stanford University, whose work is often shared through platforms such as MIT's Climate Portal and Stanford's sustainability initiatives, are actively exploring how to design AI systems that support climate and social goals while minimizing negative externalities, and their findings increasingly influence corporate and investor decision-making.

Sector Perspectives: Heavy Industry, Consumer Markets, and Digital Business

Sustainable business practices manifest differently across sectors and regions, yet the underlying capital logic remains consistent: investors reward companies that demonstrate credible, data-driven strategies for managing material environmental and social risks while positioning themselves to capture transition-related opportunities. In heavy industry and energy, companies in Germany, Norway, the United States, Canada, South Korea, and Japan are accelerating investments in renewable energy, green hydrogen, advanced nuclear, carbon capture and storage, and circular manufacturing. The International Renewable Energy Agency (IRENA) provides detailed analysis of renewable energy cost curves and deployment trends, which investors and lenders use to benchmark corporate transition plans and capital expenditure strategies. Firms that align their portfolios with these trajectories are better placed to secure green loans, sustainability-linked project finance, and long-dated infrastructure capital from global investors.

In consumer goods, retail, and fast-moving consumer sectors across the United States, United Kingdom, France, Italy, Spain, and Australia, sustainability is increasingly embedded into product design, sourcing, packaging, and brand positioning. Major brands commit to science-based climate targets validated by the Science Based Targets initiative (SBTi) and report against standards developed by the Global Reporting Initiative (GRI), whose disclosure frameworks are widely used for non-financial reporting. Investors pay close attention to deforestation-free supply chains, labor practices, circular packaging, and product life-cycle impacts, recognizing that regulatory measures such as extended producer responsibility and carbon pricing can materially affect margins and growth prospects. Companies that transparently link sustainability commitments to capital expenditure, innovation pipelines, and pricing strategies tend to command higher trust and, in many cases, valuation premiums.

Digital platforms, fintech providers, and crypto-related businesses-many of which are covered in BizFactsDaily's crypto section and broader business coverage-are also under growing scrutiny from investors and regulators. The energy intensity of data centers, blockchain networks, and AI training clusters has become a central consideration, particularly in regions such as the United States, Europe, China, and Singapore where data infrastructure is concentrated. Reports from The World Bank on digital development and sustainability and from the International Telecommunication Union (ITU) on greening digital infrastructure provide guidance on reducing the environmental footprint of digitalization. Investors increasingly ask detailed questions about energy sourcing, hardware lifecycle management, data privacy, algorithmic fairness, and financial inclusion, recognizing that reputational and regulatory risks in the digital domain can rapidly translate into financial materiality.

Regional Dynamics and Shifting Capital Flows

The audience of BizFactsDaily.com operates across a diverse set of jurisdictions, each with its own regulatory frameworks, investor cultures, and sectoral strengths, yet sustainable business practices are emerging as a common denominator in capital allocation decisions. In North America, particularly the United States and Canada, large pension funds, insurance companies, and asset managers are integrating climate scenario analysis, diversity metrics, and community impact considerations into their investment processes, even as public debates about ESG terminology persist. Organizations such as Canada's Responsible Investment Association and the U.S. Department of Energy, through its clean energy finance and data portals, provide region-specific insights that help investors evaluate decarbonization pathways and associated investment risks and opportunities.

In Europe, countries including Germany, France, the Netherlands, Sweden, Denmark, Spain, and Italy are at the forefront of embedding sustainability into corporate governance, banking supervision, and capital markets regulation. European investors often apply more demanding expectations around climate transition plans, human rights due diligence, and supply chain transparency, drawing on technical guidance from bodies such as the European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA), which publish sustainable finance guidelines and risk reports. Companies seeking to access European capital pools increasingly establish dedicated sustainability committees at board level, link executive compensation to ESG targets, and adopt robust due diligence processes to meet these expectations.

Across Asia, capital is rapidly gravitating toward sustainable infrastructure, clean energy, and inclusive financial services. Singapore positions itself as a regional green finance hub, with MAS-backed initiatives and taxonomies guiding cross-border investment into Southeast Asia. Japan's institutional investors, supported by stewardship codes, have become more assertive in engaging portfolio companies on climate strategies and human capital management. South Korea's large conglomerates are scaling net-zero commitments and circular economy initiatives, while markets such as Thailand, Malaysia, and Indonesia are expanding green bond and sustainability-linked loan issuance with backing from multilateral institutions like the World Bank Group and the Asian Development Bank, whose sustainable finance programs channel capital into emerging economies. In Africa and South America, countries such as South Africa and Brazil are attracting growing volumes of sustainability-linked capital in renewable energy, sustainable agriculture, and nature-based solutions, often supported by blended finance structures that mitigate risk for private investors.

Employment, Talent, and Organizational Capability

Sustainable business practices are not solely a matter of disclosure and capital allocation; they depend on organizational capabilities, specialized talent, and a culture that can translate high-level commitments into operational reality. Employers across the United States, United Kingdom, Germany, Canada, Australia, Singapore, and the Nordic countries are experiencing strong demand for professionals in sustainability strategy, climate risk modeling, ESG data analytics, sustainable supply chain management, and impact measurement. For readers of BizFactsDaily's employment section, this shift is reshaping workforce planning, training priorities, and leadership development, as boards and executive teams recognize that credible engagement with investors, regulators, and civil society requires internal expertise rather than purely external advisory support.

Educational institutions and professional bodies are rapidly expanding their offerings to meet this demand. The CFA Institute, for example, has developed an ESG Investing Certificate that equips investment professionals with tools to integrate sustainability into financial analysis, while universities in the United States, United Kingdom, Germany, France, Singapore, and Australia are launching interdisciplinary programs that combine finance, data science, climate science, and public policy. This growing talent pipeline enhances the sophistication of discussions between companies and capital providers, reduces information asymmetries, and strengthens trust, which in turn supports more efficient pricing of sustainability risks and opportunities across asset classes.

Reputation, Trust, and the Imperative to Avoid Greenwashing

As sustainability becomes central to capital allocation, the risk of greenwashing-making exaggerated, selective, or misleading claims about environmental or social performance-has intensified. Investors, regulators, and civil society organizations have responded with heightened scrutiny and, increasingly, enforcement. Authorities such as the U.S. Federal Trade Commission (FTC), which maintains Green Guides on environmental marketing claims, and the European Commission, through its initiatives on substantiating green claims, have made clear that deceptive sustainability messaging can trigger legal and financial consequences. For companies, this environment means that sustainability narratives must be grounded in verifiable data, subject to internal controls and, where appropriate, external assurance.

Independent verification frameworks, rating agencies, and standardization bodies play an expanding role in this ecosystem. The International Organization for Standardization (ISO) continues to develop and refine standards related to environmental management, social responsibility, and governance, such as ISO 14001 and ISO 26000, which many companies use to structure their management systems and reporting. Investors increasingly differentiate between firms that embrace rigorous measurement, transparent reporting, and continuous improvement, and those that rely on vague commitments or marketing-driven initiatives. The former group tends to enjoy stronger investor confidence, more resilient valuations, and better access to long-term capital, while the latter faces growing reputational risks and potential regulatory sanctions.

How BizFactsDaily.com Frames Sustainability for Capital Decision-Makers

Within this evolving landscape, BizFactsDaily.com positions sustainability not as a standalone theme but as a critical lens across all its coverage areas, reflecting the reality that environmental and social factors now permeate every major business decision. Articles in the investment section examine how sustainability metrics influence portfolio construction, risk management, and asset allocation across regions, while insights in the global section explore how cross-border capital flows respond to regulatory shifts, trade dynamics, and geopolitical developments related to climate and resource security. Features in the sustainable business channel look at how companies in sectors from heavy industry and energy to fintech and crypto are operationalizing their commitments and responding to investor expectations.

This integrated approach allows readers to move seamlessly between macroeconomic analysis in the economy section, coverage of digital transformation and automation in the technology pages, and updates on emerging trends in artificial intelligence, crypto, and global employment. For a global audience that includes executives, founders, investors, and policymakers, BizFactsDaily.com aims to provide the experience, expertise, authoritativeness, and trustworthiness required to navigate the complexities of sustainable finance and strategy in 2026. By combining in-depth reporting, expert commentary, and curated external resources-from multilateral organizations and leading universities to regulators and standard setters-the platform helps decision-makers understand not only what is changing, but how those changes affect valuation, capital access, competitive positioning, and long-term resilience.

Sustainability as a Long-Term Competitive Advantage

Looking ahead through the remainder of the decade, the linkage between sustainable business practices and global capital flows is likely to intensify rather than fade. Physical climate risks are becoming more visible in the form of extreme weather, water stress, and supply chain disruptions, while regulatory responses-from carbon pricing and disclosure mandates to product standards and trade measures-are expanding across North America, Europe, Asia, and increasingly Africa and South America. Social issues such as inequality, workforce well-being, digital ethics, and community impact are gaining prominence in investor dialogues, and governance failures can destroy value at unprecedented speed in a hyper-connected information environment.

For companies, the strategic question is no longer whether to integrate sustainability, but how to do so in a way that is credible, measurable, and aligned with long-term value creation across multiple stakeholder groups. Organizations that embed sustainability into core strategy, capital allocation, innovation, risk management, and culture will be best positioned to attract and retain global capital, recruit top talent, and maintain regulatory and social license to operate. Those that treat it as a peripheral concern, or as a purely marketing-driven initiative, risk being marginalized as investor expectations, regulatory frameworks, and competitive benchmarks continue to evolve.

For the global readership of BizFactsDaily.com, the implication is clear: sustainable business practices have become a central determinant of competitiveness and investability in 2026, cutting across sectors from AI and advanced manufacturing to banking, crypto, and consumer markets, and spanning regions from the United States and Europe to Asia, Africa, and South America. Staying informed, analytical, and forward-looking-through platforms such as BizFactsDaily's main business hub and the broader insights available on BizFactsDaily.com-is now an essential part of leadership in capital markets that increasingly reward those who align financial performance with long-term environmental and societal stability.