How Data Analytics Is Redefining Market Transparency in 2026

Market Transparency in a Hyper-Connected Data Economy

In 2026, market transparency has become one of the most decisive differentiators between resilient, investable organizations and those that struggle to earn the confidence of regulators, counterparties and end customers. At BizFactsDaily.com, the editorial team observes across daily coverage that the most credible institutions in banking, capital markets, crypto, technology and sustainable finance are those that have elevated data analytics from a back-office utility to a board-level strategic capability, tightly integrated with governance, risk management and stakeholder communication. As capital now moves globally with near-instantaneous speed, and as investors in the United States, Europe, Asia-Pacific, Africa and Latin America allocate capital across increasingly complex instruments, from tokenized real-world assets and structured products to algorithmically managed ETFs and decentralized finance protocols, the ability to collect, validate, analyze and share high-quality data has become central to how modern markets function and how trust is established or lost.

Global bodies such as the International Monetary Fund underscore in their ongoing Global Financial Stability Reports that transparent markets underpinned by robust data are more resilient to shocks, less prone to mispricing and better equipped to allocate capital efficiently. This theme is echoed across the sectors that BizFactsDaily tracks for its international readership, whether in artificial intelligence, banking, stock markets, crypto, or sustainable finance. What has changed by 2026 is not only the volume of available data but the sophistication of analytics applied to it, and the expectation from regulators and institutional investors that organizations will be able to explain, evidence and defend their decisions using data-driven insights.

In this environment, data analytics functions simultaneously as a governance mechanism, a risk radar and a strategic lens. It converts transactional records, market feeds, customer interactions, supply chain events and public disclosures into decision-ready intelligence that allows leaders to see through layers of opacity, detect misconduct earlier, benchmark performance more accurately and communicate with stakeholders in ways that can be independently verified. For the global audience of BizFactsDaily, whose interests span business, investment, economy and global trends, understanding how analytics concretely improves transparency has become essential to evaluating counterparties, designing compliant products, entering new markets and building digital-first business models that can withstand regulatory and reputational scrutiny.

Redefining Market Transparency in the Age of Advanced Analytics

Historically, market transparency was largely defined by the availability and timeliness of information about prices, volumes, order flows and fundamental drivers of value. In analogue markets dominated by a small number of intermediaries, constraints arose from slow communication, paper-based records and limited regulatory visibility. In 2026, markets are digital, fragmented and algorithmically intermediated; information is abundant but unevenly interpretable, and informational advantages are less about privileged access to raw data and more about the capacity to cleanse, structure and analyze it at scale.

Data analytics reshapes the very definition of transparency by adding the dimensions of interpretability, comparability and usability. A dataset may be technically public yet practically opaque if only a narrow set of firms possess the tools and expertise to derive insight from it. Institutions such as the Bank for International Settlements have highlighted in their work on market structure and data that advanced analytics can either narrow or widen information asymmetries depending on how broadly analytical capabilities are distributed across market participants. This reality is now embedded in regulatory thinking in the United States, the European Union, the United Kingdom, Singapore and other leading financial centers, where supervisors increasingly expect firms to demonstrate not only that they report data accurately, but that they can understand the outputs of their own models and explain them in non-technical terms.

For organizations followed by BizFactsDaily, this evolution means that analytics is no longer just a lever for operational efficiency or trading edge; it is part of their public contribution to fair and orderly markets. As readers explore themes in employment, innovation and technology, they see that firms able to operationalize analytics responsibly are better positioned to meet emerging expectations around algorithmic accountability, model risk management and explainable artificial intelligence. Market transparency in 2026 therefore encompasses not only what is disclosed, but how intelligible, verifiable and comparable those disclosures are once processed through modern analytical frameworks.

Mechanisms Through Which Analytics Enhances Transparency

The contribution of data analytics to market transparency can be understood across several interconnected mechanisms that cut across asset classes and geographies: price discovery, risk assessment, disclosure quality, surveillance and stakeholder communication. These mechanisms are visible on established venues such as the New York Stock Exchange, London Stock Exchange and Deutsche Börse, as well as on crypto exchanges, digital asset platforms and decentralized finance protocols.

In price discovery, advanced analytics aggregates, normalizes and reconciles data from multiple trading venues, dark pools, over-the-counter platforms and alternative data sources, creating consolidated views of bids, offers, trades and reference rates. In fragmented equity and foreign exchange markets, smart order routing and transaction cost analysis systems rely heavily on real-time analytics to identify best execution opportunities and measure slippage, which in turn encourages tighter spreads and more efficient pricing. Regulatory initiatives such as consolidated tapes in Europe under MiFID II and its upcoming revisions depend on standardized, machine-readable data and analytics, supported by technical work from bodies like ESMA, whose guidance and reports aim to make post-trade information more accessible for both institutional and sophisticated retail investors.

In risk assessment, data analytics enables more granular and dynamic views of credit, market, liquidity, climate and operational risks. Banks, asset managers and insurers now incorporate macroeconomic, sectoral and even climate scenario data into stress-testing frameworks, often using open datasets from the World Bank, which provides extensive global development and economic indicators. These tools allow institutions and regulators to evaluate how shocks in one region or sector may propagate through supply chains, labor markets and funding channels, a theme that resonates with BizFactsDaily readers tracking cross-border economy and employment impacts in markets from the United States and Germany to Brazil, South Africa and Southeast Asia.

Disclosure quality has also been transformed. Natural language processing and text analytics are now routinely applied to annual reports, regulatory filings, earnings calls and sustainability statements to detect sentiment shifts, identify inconsistencies and flag potential greenwashing or misrepresentation. Institutions such as the OECD continue to develop principles for corporate governance and responsible business conduct, and analytics has become the practical engine through which investors, analysts and regulators benchmark disclosures across jurisdictions such as the United Kingdom, France, Japan and Canada. As machine-readable formats such as XBRL become standard for financial and ESG reporting, the line between regulatory compliance and investor analytics is increasingly blurred, with transparency enhanced by the ease with which stakeholders can interrogate and compare data.

Surveillance and market integrity represent another critical mechanism. Exchanges, regulators and even large market participants now deploy anomaly detection, pattern recognition and graph analytics to monitor trading behavior, communication records and, in the case of digital assets, on-chain transactions. The Financial Stability Board emphasizes in its policy work on market integrity and non-bank finance that data-driven supervision is essential to detect manipulation, insider trading, wash trading and other forms of misconduct in near real time. This is particularly important in cross-border derivatives, commodities and crypto-asset markets, where misconduct can rapidly undermine confidence and generate systemic spillovers.

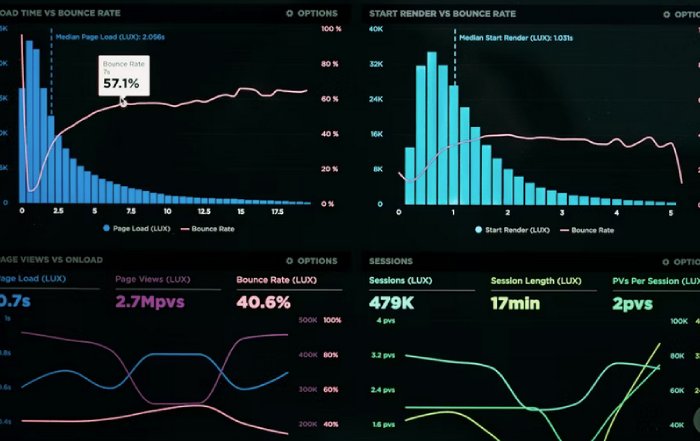

Finally, analytics has changed how organizations communicate with stakeholders. Investor relations and corporate strategy teams increasingly rely on dashboards, scenario analyses and interactive visualizations to explain performance, risks and strategic choices. For the global business audience of BizFactsDaily, this shift toward data-backed narrative is visible in earnings presentations, capital markets days and sustainability reports from major institutions in the United States, Europe, Asia and emerging markets, where transparency is judged not only by the volume of disclosure but by the clarity and coherence of data-driven explanations.

Traditional Capital Markets: From Opaque Fragments to Data-Rich Systems

In traditional capital markets, encompassing equities, fixed income, derivatives and commodities, data analytics has become embedded in the core infrastructure of trading, clearing, settlement and risk management. Exchanges, brokers, asset managers, custodians and regulators now depend on sophisticated analytics to ensure fair access, robust price formation and accurate measurement of exposures. For readers of BizFactsDaily following stock markets and investment strategies, these analytical capabilities increasingly define the competitive landscape.

On the trading side, algorithmic and high-frequency strategies use millisecond-level data on order book dynamics, cross-asset correlations and news sentiment to provide liquidity and arbitrage price discrepancies across venues and regions. While such strategies have prompted debates about market fairness and technological arms races, they have also contributed to narrower spreads and more continuous pricing, especially when monitored by robust surveillance analytics. Market operators such as NASDAQ and CME Group invest significantly in analytics to monitor their own venues, publishing detailed market quality and liquidity metrics that enable participants to evaluate execution quality and venue selection. In the United States, the U.S. Securities and Exchange Commission continues to release market structure analysis and data that rely on large-scale analytics to assess the effects of rule changes, payment-for-order-flow models and retail participation on transparency and fairness.

Fixed income and derivatives markets, historically more opaque due to over-the-counter trading and bespoke contracts, have seen notable improvements in transparency driven by data analytics and post-trade reporting mandates. Trade repositories aggregate transaction data across dealers and platforms, which analytics providers transform into yield curves, liquidity scores and pricing benchmarks that are increasingly accessible to a broader range of investors, including smaller institutions and family offices. The European Central Bank demonstrates in its statistics and research how granular bond and derivatives data can be used to analyze fragmentation, liquidity and the transmission of monetary policy, providing both policymakers and market participants with deeper insights into the structure and vulnerabilities of European markets.

Risk management has advanced in parallel. Value-at-Risk, expected shortfall and margin models now integrate high-frequency market data, macro indicators, geopolitical risk signals and climate scenarios, allowing more realistic stress tests and more transparent capital planning. Institutions such as the Bank of England publish comprehensive financial stability reports and systemic risk analyses that rely on network analytics to map interconnected exposures across banks, asset managers, hedge funds and non-bank financial intermediaries. These analyses not only inform macroprudential policy but also provide market participants with benchmarks against which to assess their own risk profiles, enhancing system-wide transparency.

For BizFactsDaily readers across North America, Europe and Asia, these developments mean that traditional markets, while still complex, are now more observable and analyzable than at any point in history. The organizations that stand out are those that do not treat analytics merely as a regulatory necessity but as a strategic tool to improve execution quality, reduce hidden costs, anticipate liquidity stresses and communicate risk in ways that investors and regulators can independently validate.

Crypto, Digital Assets and the Analytics-Transparency Paradox

The digital asset ecosystem, spanning cryptocurrencies, stablecoins, tokenized securities, non-fungible tokens and decentralized finance, continues to evolve rapidly in 2026, and with it the role of analytics in resolving a fundamental paradox. Public blockchains such as Bitcoin and Ethereum provide immutable, open ledgers where every transaction is theoretically observable, yet the complexity of smart contracts, the pseudonymous nature of addresses and the proliferation of off-chain activities can obscure real risk, leverage and ownership structures. Data analytics is the indispensable bridge that transforms this raw, unstructured on-chain activity into actionable transparency.

Specialized blockchain analytics firms, research labs and in-house teams at major financial institutions use clustering algorithms, graph theory and machine learning to identify relationships between addresses, trace the movement of funds and detect illicit activities, from ransomware and sanctions evasion to wash trading and market manipulation. The Financial Action Task Force recognizes in its guidance on virtual assets and service providers that such analytics are vital for implementing effective anti-money laundering and counter-terrorist financing controls in crypto markets. For institutional investors in the United States, the United Kingdom, Singapore, Switzerland and the United Arab Emirates, analytics-driven transparency is now a prerequisite for regulatory approval, risk committee sign-off and board-level comfort with digital asset exposure.

In decentralized finance, where lending, trading, derivatives and asset management are executed through smart contracts rather than traditional intermediaries, data analytics enables real-time monitoring of protocol health, collateralization levels, liquidity pools, governance proposals and user concentration. Public dashboards and risk analytics platforms visualize on-chain metrics in a form that risk managers, regulators and sophisticated retail users can interpret, helping them to identify vulnerabilities such as excessive leverage, oracle manipulation risks or liquidity mismatches. Research by the Bank for International Settlements, reflected in its papers on crypto and DeFi, illustrates how analytics can reveal hidden interconnections between protocols and centralized entities, enabling earlier identification of systemic risks that might otherwise remain obscured behind pseudonymous addresses.

For the BizFactsDaily community following crypto and technology innovation, analytics has become a core criterion for assessing which platforms are genuinely transparent and which are not. Digital asset exchanges and custodians that publish real-time or frequent proof-of-reserves attested by independent firms, supported by on-chain verification, are increasingly distinguished from opaque entities that provide limited visibility into their balance sheets, governance or risk management. As regulatory frameworks in the European Union, United Kingdom, United States and Asia mature, analytics-driven transparency is emerging as a key factor in licensing decisions, investor appetite and cross-border recognition of digital asset service providers.

Regulatory Technology, Supervisory Analytics and Smarter Oversight

Regulators and supervisors worldwide have embraced data analytics as a core instrument in fulfilling their mandates to protect investors, safeguard financial stability and ensure fair, efficient markets. The rise of regulatory technology (RegTech) and supervisory technology (SupTech) reflects a shift from periodic, manual supervision toward continuous, data-driven oversight that can adapt to high-frequency markets and complex financial innovation. For businesses concerned with compliance costs and regulatory risk, this evolution means that analytics is now embedded on both sides of the supervisory relationship.

Authorities such as the Monetary Authority of Singapore have been at the forefront of adopting SupTech solutions and data-driven supervision, using advanced analytics to process large volumes of transactional, reporting and market data in near real time. These tools enable supervisors to detect anomalies, monitor conduct, evaluate systemic risks and assess the impact of new regulations with far greater granularity than traditional approaches allowed. Similarly, the European Securities and Markets Authority leverages analytics to oversee market abuse frameworks, cross-border fund distribution and benchmark administration, providing market participants with guidance and thematic reports that clarify supervisory expectations and promote consistent application of rules across the European Union.

On the industry side, RegTech providers integrate regulatory texts, transaction data, communications and internal policies into platforms that automate reporting, monitor compliance in real time and generate alerts for potential breaches. The International Organization of Securities Commissions has documented in its reports on fintech, RegTech and market oversight how such technologies can reduce compliance burdens while simultaneously enhancing the quality and timeliness of information available to regulators, thereby improving overall market transparency. For multinational firms operating across North America, Europe, Asia and emerging markets, the ability to harmonize data models and analytics across jurisdictions is becoming a strategic differentiator in managing regulatory complexity.

From the vantage point of BizFactsDaily, which monitors news and regulatory developments across continents, the interplay between analytics and supervision is reshaping the compliance function. Organizations that invest in robust data infrastructure, standardized taxonomies and explainable models are better positioned not only to satisfy evolving rules in the United States, United Kingdom, European Union, Singapore, Australia and beyond, but also to repurpose regulatory data for strategic insights, such as benchmarking against peers, identifying emerging risks and informing capital allocation.

ESG, Sustainability and the Quest for Credible Data

Sustainability and ESG (environmental, social and governance) considerations have become mainstream drivers of capital allocation, corporate strategy and regulatory policy, yet persistent concerns remain about data quality, comparability and the risk of greenwashing. By 2026, data analytics has moved to the center of efforts to make ESG information more transparent, credible and decision-useful for investors, regulators and civil society. For BizFactsDaily readers exploring sustainable strategies and climate-aligned investment, the ability to interrogate ESG claims analytically has become indispensable.

Frameworks developed by bodies such as the Task Force on Climate-related Financial Disclosures and the International Sustainability Standards Board are being operationalized through analytics platforms that standardize, aggregate and interpret corporate climate and sustainability disclosures. Investors increasingly combine reported metrics with external datasets, including satellite imagery, geospatial data and supply chain information, to validate corporate claims on emissions, biodiversity, labor practices and community impact. Resources from the United Nations Environment Programme, which provides environmental data and assessments, are often integrated into these analytical models, enabling more objective scrutiny of how companies in sectors from energy and manufacturing to technology and finance are performing against their stated commitments.

ESG analytics providers now aggregate disclosures, regulatory filings and alternative data to generate scores, controversy indicators and thematic insights that investors use to construct portfolios aligned with net-zero pathways, social inclusion objectives or governance best practices. Organizations such as the World Economic Forum highlight in their work on sustainable finance and corporate transformation that rigorous analytics is essential to channel capital toward genuinely impactful projects and away from superficial or misleading claims. For companies operating in the United States, Canada, the United Kingdom, Germany, France, Japan, South Korea and emerging markets, this means that sustainability narratives must be backed by verifiable data, robust methodologies and a willingness to expose ESG performance to independent analytical scrutiny.

From a corporate governance perspective, analytics-driven ESG transparency is both a compliance requirement and a strategic opportunity. Firms that invest in end-to-end data collection across operations and supply chains, integrate climate and social metrics into core enterprise systems and commit to third-party verification can differentiate themselves in competitive capital markets. Those that rely on vague or selective disclosures face increasing regulatory and reputational risk as investors, regulators and media organizations-including BizFactsDaily.com-use advanced analytics to test the credibility of sustainability commitments and to highlight discrepancies between rhetoric and reality.

Building Organizational Capabilities: Analytics as a Trust Infrastructure

For organizations across banking, technology, manufacturing, services and the public sector, data analytics and market transparency are now deeply intertwined with internal capabilities, culture and governance. Coverage at BizFactsDaily of leading founders, executives and innovators reveals a consistent pattern: institutions that command lasting trust are those where data literacy, ethical analytics and transparent decision-making are embedded from the board level down to operational teams.

Effective data governance is the starting point. Organizations must ensure that the data feeding their analytical systems is accurate, complete, timely and collected in compliance with privacy and cybersecurity regulations. Frameworks such as the European Union's General Data Protection Regulation and the California Consumer Privacy Act provide detailed guidance on lawful and transparent data processing, and non-compliance can quickly erode trust and invite regulatory sanctions. High-quality data, clear lineage, documented transformations and robust access controls are now prerequisites for credible analytics, especially in sensitive domains such as credit scoring, employment decisions, health-related services and personalized marketing.

Analytical expertise must then be coupled with domain knowledge. Data scientists, machine learning engineers and quantitative analysts need to work closely with business leaders, risk managers, compliance officers and legal teams to ensure that models are not only statistically sound but also aligned with regulatory standards and ethical expectations. Institutions such as MIT Sloan School of Management and INSEAD have developed research and executive programs on data-driven decision-making and analytics leadership, emphasizing the importance of cross-functional collaboration, model governance and continuous validation. Organizations that invest in such capabilities are better positioned to use analytics to illuminate risks and opportunities rather than to obscure them.

Explainability has emerged as a central pillar of trustworthy analytics. As AI and machine learning models are deployed in areas such as lending, underwriting, fraud detection, trading and customer segmentation, regulators and stakeholders increasingly demand that decisions be understandable, contestable and free from unjustified bias. Supervisory authorities in Europe, North America and Asia are moving toward explicit requirements for explainable AI in high-risk use cases, and firms that can articulate how their models work, what data they depend on and how biases are mitigated will find it easier to maintain regulatory approval and stakeholder confidence. For BizFactsDaily readers focused on artificial intelligence and innovation, this convergence between technical transparency and market transparency is now a recurring theme in boardroom discussions and risk committee agendas.

Communication strategies must evolve accordingly. Investor relations, marketing and corporate communications teams are increasingly expected to present metrics, dashboards and scenario analyses rather than purely narrative statements. Transparency becomes a continuous process of sharing data, methodologies and context, not a once-a-year exercise confined to annual reports. Organizations that adopt this approach, whether headquartered in New York, London, Frankfurt, Singapore, Tokyo, Sydney, Johannesburg or São Paulo, are better able to build durable trust with investors, regulators, employees and customers, as their claims can be tested and validated through independent analytical lenses.

Strategic Implications for Global Businesses and Investors

For the global audience of BizFactsDaily, spanning banking, technology, economy, marketing and broader business themes, the strategic implications of analytics-driven transparency in 2026 are far-reaching. Competitive advantage increasingly hinges on the ability to harness data analytics not only for internal optimization but also to operate credibly in markets where stakeholders expect evidence-based communication, verifiable disclosures and responsive risk management.

Investors who integrate advanced analytics into their due diligence, portfolio construction and risk monitoring processes can better distinguish between robust business models and those that rely on opacity, aggressive accounting or regulatory arbitrage. They can interrogate financial statements, ESG reports and public communications using both structured and unstructured data, cross-check corporate claims against independent sources such as the World Bank, IMF or UNEP, and monitor real-time indicators of financial health, governance quality and sustainability performance. In parallel, businesses must recognize that every assertion they make about strategy, resilience, innovation or impact is now subject to scrutiny through increasingly powerful analytical tools deployed by asset managers, regulators, media outlets and civil society.

At a system level, the integration of analytics into market infrastructure, regulatory regimes and corporate governance offers the prospect of more resilient, inclusive and efficient markets, but it also introduces new challenges related to data concentration, algorithmic bias, cyber risk and diverging national approaches to data sovereignty. Policymakers, industry leaders and technology providers will need to collaborate through international fora supported by organizations such as the World Bank, IMF, FSB and regional standard setters to ensure that the benefits of analytics-driven transparency are broadly shared and that new forms of opacity or exclusion do not emerge. Learn more about sustainable business practices and their interaction with data and regulation through the analytical coverage available on BizFactsDaily.com.

As 2026 unfolds, BizFactsDaily.com will continue to follow how data analytics reshapes transparency across sectors and regions, from Wall Street and the City of London to Frankfurt, Singapore, Hong Kong, Toronto, Sydney, Johannesburg, São Paulo and beyond. For decision-makers, the imperative is clear: invest in trustworthy data foundations, build analytical capabilities underpinned by strong governance, engage proactively with regulators and stakeholders, and treat transparency not as a narrow compliance obligation but as a strategic asset that underwrites long-term value creation in an increasingly complex, data-saturated and interconnected global economy.